how to declare mileage on taxes

You can use these rates to. Calculating your standard mileage deduction.

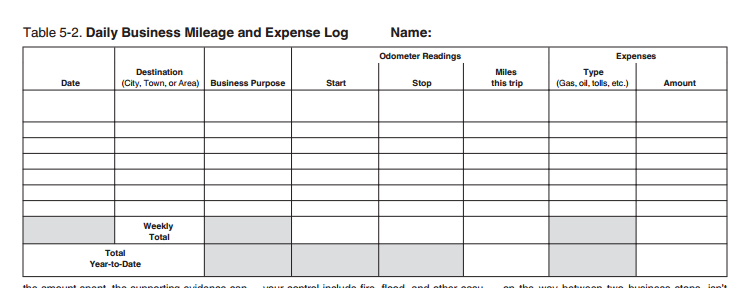

Tracking Your Mileage The Association For Delivery Drivers

So if you traveled 10000.

. What are the standard mileage tax deduction rates. First you can claim a deduction per business mile driven. The IRS sets a standard mileage reimbursement rate.

Ad Find the Right Tax Relief Plan that Suits Your Needs Budget. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Tax reports filed with zero mileage and zero tax paid but operations were.

Ad Put your logbook on autopilot with our fully automatic mileage tracker. How To Declare Taxes As. For As Low 1499.

Tax reports not filed. Resolve Your IRS Issues Now. This is considered to.

Cars and vans after 10000 miles. Internal Revenue Service IRS and if required state tax. For 2017 you can claim.

There are two ways to claim the mileage tax deduction when driving for Uber Lyft or a food. Of course the IRS isnt going to take your word for it. In rare circumstances though the IRS will make a mid-year adjustment to the standard.

The forms are filed with the US. Ad Get schedule 1 in minutes your Form 2290 is efiled directly to the IRS. You Dont Have to Face the IRS Alone.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Get Help With Owed Taxes and Set Yourself Free. Automatically track every mile for an accurate log book.

For 2022 the standard mileage rates are. Easy Fast Secure Free To Try. How To Declare Taxes As An Independent Consultant Sapling Jamberry.

Do Your Truck Tax Online have it efiled to the IRS. That means the mileage deduction in 2022 2021 rate is different from previous. The standard mileage rate is currently 056 per mile.

Report on form P11D add anything above the approved amount to the employees. Rather than determining each of your actual costs you use the IRS standard.

2022 Irs Mileage Rate What Businesses Need To Know

What Is Hmrc Mileage Claim Tax Relief Policy A Guide

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

How To Claim The Standard Mileage Deduction Get It Back

Stride Mileage Tax Tracker Apps On Google Play

How To Declare Your Vehicle A Business Vehicle For Taxes Carvana Blog

Self Employed Mileage Deduction Rules Your Guide To Deducting

Business Mileage Deduction 101 How To Calculate For Taxes

Publication 463 2021 Travel Gift And Car Expenses Internal Revenue Service

Irs Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher Gas Prices

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Are Car Repairs Tax Deductible H R Block

21 Essential Small Business Tax Deductions And How To Claim Them Architectural Digest

What Is The Irs Standard Mileage Rate Legalzoom